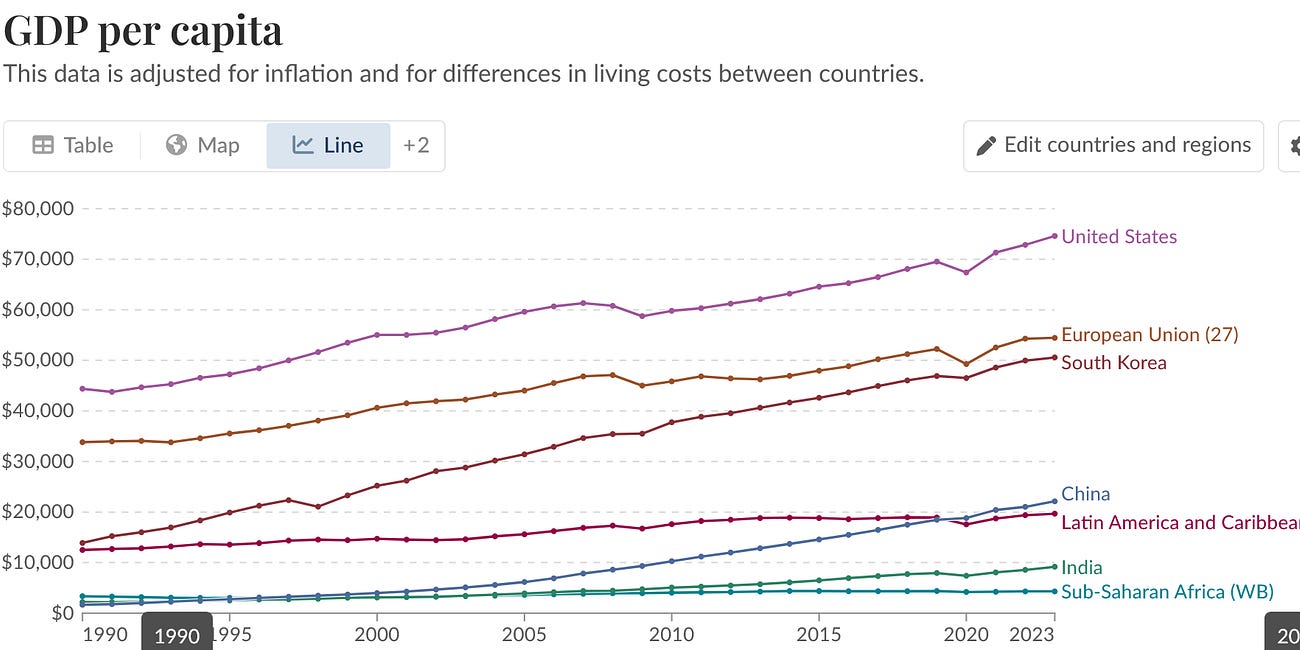

US doesn't have to control its debt in the 2020s - it's a source of wealth to Americans and speeds recovery from recession - and many ways to do it in the 2030s

Update, this is based on an earlier projection. As of 2025 it’s more important for the US to control its debt though still with many solutions see:

Why the US does need to solve its budget crisis - but the US economy remains very strong on all projections and many solutions + shorter term ways to keep going if nothing is done by 2030

I’m often asked why is Trump cutting so much government spending? What was the actual point in DOGE? Many I help don't know the answer to it and are baffled by what’s going on

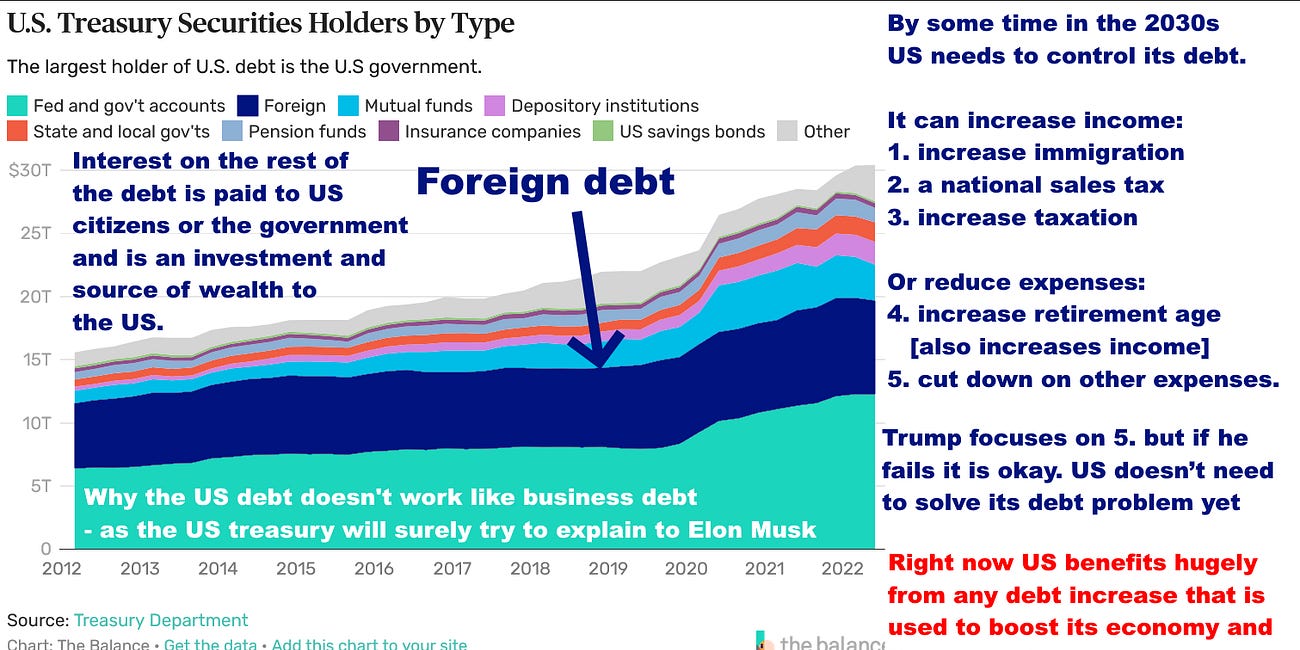

The US does need to control its debt eventually but not until the 2030s. It is not like a household debt. It is actually a source of wealth to many Americans who invest in government bonds and most of the debt is owed to Americans.

.TEXT ON GRAPHIC:

Foreign debt (arrow) in dark blue

Interest on the rest of the debt is paid to US citizens or the government and is an investment and source of wealth to the US.

Why the US debt doesn’t work like business debt

- as the US treasury will surely try to explain to Elon Musk.By some time in the 2030s US needs to control its debt.

It can increase income:

1. increase immigation

2,. a national sales tax.

3. increase taxation.

Or reduce expenses

4. increase retirement age

[also increases income]

5. cut down on other expenses.

Trump focuses on 5. but if he fails it is okay. US doesn’t need to solve its debt problem yetGraphic from: Who Owns the US National Debt?

This summarizes some of the things in my BLOG: Why the US's national debt overwhelmingly benefits Americans — and the US can never default on its debt — only needs to control it in the 2030s — with many solutions

It was right for both Trump AND Biden to take on extra debt during a recession as this boosts the economy and leads to more income for the government. What's important is to invest the debt in things that will help strengthen the economy. That is what Biden did with the Bipartisan infrastructure bill and the inflation reduction act and America is now experiencing the benefits of them.

The main issue with what Biden did is that he was looking out for the economy in the timescale of a decade or so with most of the effects of those bills happening beyond the end of his presidency - that combined with various external factors outside his control is the main wreason the Democrats lost the election and meant that whoever was elected president would see a recovering economy unless they mess up really badly.

Then there are many ways that the US can reduce the debt in the 2030s. As you see from the graphic, one of them is to boost immigration because that increases income to the government and reduces payments as immigrants tend to pay more and use less than citizens gbecause they are younger and more entrepreneural - Elon Musk is an immigrant and is an example of how they tend to be somewhat more likely to start new businesses that benefit the US economy.

Another is to increase the retirement age by a few years like many other countries have done.

Or a national sales tax or increase taxation.

Or it can cut down on other expenses. That is what Trump is trying to do.

But the US doesn't have to control its debt for another few years yet. If Trump fails to reduce expenses significantly it's no big deal.

There are all those other ways to do it and right now it's not the priority, it still is recovery from the recession and it makes sense still to take on more debt.

This is a breakdown of the owners of the public debt. As you see, 2/3 of the interest goes straight into the US economy:

That is one of the biggest differences from business debt. Another is that by taking on debt, if it is done wisely to boost the economy and GDP, there is more income to tax and so, more revenue for the government.

So the analogy of a business or household debt is very very misleading.

For more on this see my:

Why the US's national debt overwhelmingly benefits Americans - and the US can never default on its debt - only needs to control it in the 2030s - with many solutions

The US can easily service its debt. The servicing is only 23% of total government income, and what most people don't realize is 70% of the interest on the debt actually goes to Americans or back to the US government itself. The national debt is a source of wealth for them. So the US is supporting its own economy by servicing the National Debt.