Trump does tariffs he thinks will benefit the US economy - if economists are right he'll soon find they don't - and likely to reverse course - can also be stopped in the courts

Trump’s motive for the tariffs is to lower prices, and boost the US industry all the while helping to control the US debt and increase Federal revenue.

First to reassure you, you notice the price increases pretty much immediately in the USA. In other areas like the EU it may lead to price decreases. But any effects on the economy happen gradually over weeks to months.

The risk in the USA is inflation which would drive up the costs not reduce them. Longer term the risk is higher costs, inflation falling not so much and reduced GDP growth in the USA.

The US economy is very strong. As a result of the election campaign - many last year thought it was already in recession but it wasn't.

In reality, the US economy was on the road to recovery and with normal GDP growth. That is why it’s not going to dip into a recession immediately and not likely for months or at all.

Trump seems to be very ill informed about economics, most economists say his plan makes no sense. But he will be expecting falling prices and increased employment and a falling trade deficit. When none of that happens as the economists predict, that's when he will need to pivot.

Short summary of the economic theory - why economicsts say this won’t work

Some economists say this is possible but only with specially targeted tariffs.

For instance, some economists say that:

tariffs on imported electric vehicles COULD boost the domestic electric vehicles industry - if done carefully and supported by other things that also boost the industry.

However there is

no way to use tariffs to boost the domestic production of diamonds- the US just doesn’t have economically viable diamond mines any more.

Similarly:

No way to use tariffs to boost the domestic production of coffee as even Florida isn’t warm enough to grow coffee except in greenhouses which will remain more expensive.

All tariffs on diamonds or coffee do is drive up the cost of diamonds and coffee for Americans for no purpose because they will never stimulate a native US diamonds or coffee industry.

This graphic explains why economists say what Trump does won’t work.

He is trying to use tariffs to change the balance of Imports - Exports. If he could reduce the deficit to 0 then the US would export as much as it imports and the US debt would stop rising.

But this will only work if he changes the way that things are done inside the USA as a result.

The balance of Imports - Exports is given by the formula:

Imports - Exports

= (Domestic Savings - Domestic Investment) + (Taxes - Government Expenditure)

We’ll go into the details of why later but the main thing is that you have to change things internally in the USA and can’t reduce the deficit just by using strong arm tactics on the trade.

To reduce the trade deficit, which governs how much US debt increases each year, you have to do at least ONE of these things:

increase domestic savings (amount of money Americans save that can be used for investment in the USA)

reduce domestic investment (reduce the amount of investment in projects / businesses etc in the USA)

increase taxes

reduce government expenditure.

If the tariffs help the situation they have to help by changing at least one of those things in a way positive for the USA.

Or you can just run at a negative trade balance and allow the US debt to continue to rise. That is possible

if the US debt is financing an expansion in US industry

GDP rises along with the debt allowing the government to cover expenses and cover the interest on the debt.

That is actually fine, through to the 2030s. There is actually no urgency to fix this. And we’ll find there are many ways to fix the debt issue. One of the simplest is

to increase the retirement age (reduces government expense and increases taxes on wages)

encourage more immigration (they are young and often entrepreneurs and they pay the government far more than the government expends on them

introduce VAT (to increase government expenditure) and many other ways

So that’s the basic economics of the situation. That’s why most economists say these tariffs will achieve nothing.

A minority of economists think that

carefully targeted tariffs, for instance on electric cars, could help with the trade deficit. If they succeeded in moving more manufacture of electric cars to the USA,they would increase the government income and increase the wealth of Americans allowing them to invest more.

None of the economists I found see any value in tariffs on things like coffee or diamonds for helping with the trade deficit.

Hopefully I got this right. I’m good at maths, but I’m no economist and I’ve just summarized what I read as clearly as I could. If any of you are an economist and see any flaws in any of this explanation or any mistake however small do say. I wrote this because I can’t find a clear explanation in ordinary language. I found pages full of equations which are easy for me to read but not for most folk.

Mexico and Canada get no new tariffs

Mexico and Canada don't get any new tariffs. Anything made wholly or mostly in Canada or Mexico is exempt.

QUOTE USMCA-Compliant Goods: Imports from Canada and Mexico that meet USMCA rules-of-origin standards are exempt. However, a 25 percent tariff remains on goods related to the fentanyl crisis, with a fallback 12 percent tariff for noncompliant products if the emergency expires.

https://www.csis.org/analysis/liberation-day-tariffs-explained

For the other countries see the BBC list of tariffs by country https://www.bbc.co.uk/news/articles/c5ypxnnyg7jo

Could there be a recession? - not immediately, some say a small dip may be possible over longer timescales of months - and since it’s self inflicted Trump can reverse out of it

Three main things.

If possible it's not immediate, it's for months from now.

If it did happen it's a self inflicted recession which Trump can stop by removing the tariffs and if he kept going would likely lose the House in special elections.

Recessions just mean a period when the GDP shrinks

When these are small dips and for a short time, people aren't much affected.

The IMF say based on their information so far: no recession globally and no recession in the USA.

QUOTE IMF Managing Director Kristalina Georgieva told a Reuters event this week she did not see global recession for now. She added the Fund expected shortly to make a small downward "correction" to its 2025 forecast of 3.3% global growth.

But the impact on national economies is set to diverge widely, given the spectrum of tariffs ranging from 10% for Britain to 49% for Cambodia.

https://www.japantimes.co.jp/business/2025/04/03/economy/trump-tariffs-ailing-world-economy/

Goldman Sachs say there's a 1 in 3 chance (35%) of a recession in the USA in the next 12 months - assuming the tariffs stay in place.

https://edition.cnn.com/2025/03/31/business/recession-tariffs-goldman-sachs/index.html

Most people don't notice a small short term recession and since this is self inflicted if the US is heading for a recession Trump could stop the tariffs to undo a lot of the damage.

The IMF will update its forecasts at the end of April but doesn't currently predict a US recession or expect to do so.

https://finance.yahoo.com/news/imf-assessing-trump-tariff-plans-150700641.html

What Trump is trying to do - to get other countries to spend as much on US exports as the US spends on imports - he thinks this will boost US business and lower costs

Trump has explained why he does the tariffs. He thinks they are a way to end the trade deficit which is the difference between the amount the US spends on imports and the amount it earns from exports. It’s the trade deficit that drives up the foreign debt.

Trump wants to reduce prices of US goods by encouraging Americans to make things themselves and to invest in their own industry instead of investing their savings overseas.

If this worked, American industry would benefit, they would have higher employment, reduce prices and it’s an all round good thing.

So - Trump doesn’t want to push the US into a recession as some claim. It’s the opposite. He is convinced that this will benefit the US economy and Americans.

What economists think - most say it won’t work at all - a small minority say it could work but not using across the board tariffs - e.g. the US can’t grow coffee or mine diamonds commercially and tariffs won’t change that

Most economists say that the difference between savings and investment drives the trade deficit and all tariffs will do is just shift it around.

QUOTE STARTS

So what are the tariffs actually doing?

According to the Trade Representative's explanation, the tariff rates were calculated to "drive bilateral trade deficits to zero." In more simple words, the economic policy was designed to make the U.S. export just as much as it imports.

The Financial Times spoke to economic experts who found the rationale "deeply flawed economically," and said the tariffs "would not succeed in its stated aim of 'driving bilateral trade deficits to zero.'"

Oleksandr Shepotylo, an econometrician at Aston University, Birmingham, told The Financial Times that the tariffs had "a sense of being linked to economic theory," but were unjustifiable in practice. "The formula … gives you a level of tariff that would reduce [the] bilateral trade deficit to zero. This is an insane objective. There is no economic reason to have balanced trade with all countries," he said.

https://www.snopes.com/news/2025/04/03/trump-tariff-formula/

I found one economist, Pettis, who has interesting views that go against the consensus. He thinks that it is possible to drive things the other way - to reduce the trade deficit as a way to increase the amount that Americans invest in their own economy instead of investing their savings overseas.

Tariffs might be a way to do this but only if carefully selected as part of a large policy.

For instance,

tariffs on imported electric vehicles COULD boost the domestic electric vehicles industry - if done carefully and supported by other things that also boost the industry.

However there is

no way to use tariffs to boost the domestic production of coffee as even Florida isn’t warm enough to grow coffee except in greenhouses which will remain more expensive. All that does is drive up the cost of coffee for no purpose.

According to this minority view, what Trump is doing might work if done properly. However the “across the board” tariffs that Trump uses won’t work.

This graphic is based on Pettis's example.

TEXT ON GRAPHIC:

Why across the board tariffs won't boost US industry

Trump's basic mistake

A tariff on electric vehicles COULD boost US production.

A tariff on coffee can't boost US production as it is very expensive to grow in greenhouses in the USA.Graphic from here:

https://www.flickr.com/photos/d_armentrout/3277086970

Now that we have the list of tariffs we can choose more dramatic examples.

Trump has put a 38% tariff on Botswana diamonds.

The US can’t produce diamonds competitively in the modern world, it just costs too much. It has two mines, both closed down, according to Wikipedia:

Crater of Diamonds State Park, Arkansas (Former mine now a state park)

Kelsey Lake Diamond Mine, Colorado (Former mine no longer in operation)

TEXT ON GRAPHIC: Former US diamond mine but no longer commercially viable

There is no US diamond mining industry to boost with tariffs on Botswana

Photo: Prospectors at Crater Of Diamonds State Park in Murfreesboro, AR seek their fortune

There’s no way that the 38% tariffs on Botswana mines will make them expensive enough for Americans to reopen those mines.

TEXT ON GRAPHIC

Meant as a "quick fix" of the trade deficit

- but economists say it won't work.

If Trump's tariffs work, other countries buy the same amount from the US as the US buys from them.

Trump: Botswana - sell us less diamonds - or buy more of anything ...

So that you pay exactly as much to the USA as we pay to you

Economists say this will make no difference to the trade deficit because:

Imports - Exports = (Domestic Savings - Domestic Investment) + (Taxes - Government Expenditure)

Trump says that by forcing reciprocal trade he can reduce the deficit to 0 - not expected to work.

Background graphics done by Grok 3, except top left graphic by Bing Copilot

So, even if you have the minority view that tariffs can be useful as a tool to boost your own domestic industry in some areas, for instance for electric vehicles - still it makes no sense to do across the board tariffs like this.

The US economy is in a strong position - it was NOT in a recession under Biden

Trump inherited a strong US economy under Biden. Every quarter saw growth under Biden except the first quarter of 2022.

https://tradingeconomics.com/united-states/gdp-growth

The US was already well on the road to recovery, inflation falling, GDP strong. That is why there is much less risk of a recession under Trump.

If the economy was just on the edge of a recession then yes Trump might have pushed it over into a small recession but it isn’t and that’s why it will be a long time in months or not at all to end up in a recession.

Not really a war or a conflict “retaliatory” tariffs are just to protect their own domestic industries not to punish the USA

The whole thing is just silly. Trump thinks he can solve the US trade deficit by using tariffs to ensure countries buy as much from the USA as they sell to it. But in reality the trade deficit is caused by other factors so, as in his first term it will just shift the trade deficit around.

The trade deficit, that the US buys more than it sells - is a result of two things.

That the government is receiving less through tax than it spends i.e. the federal deficit

That the Americans are saving less than they invest, so they can’t cover their investments from their own savings

It's based on a simple formula

Trading Deficit = Imports - Exports = (Domestic Savings - Domestic Investment) + (Taxes - Government Expenditure)

If the Domestic Savings are less than the Domestic Investment - then foreign investors are needed to fill the gap.

The gap could also be filled by government expenditure. But now if the Taxes are less than the Government Expenditure as well, the difference has to be covered by foreign investors.

The US has a huge gap between what it gets by way of taxes and what it spends. The US government spends about 5.5% of the GDP more than it earns in taxes.

QUOTE In CBO’s projections, the federal budget deficit in fiscal year 2025 is $1.9 trillion. Adjusted to exclude the effects of shifts in the timing of certain payments, the deficit grows to $2.7 trillion by 2035. It amounts to 6.2 percent of gross domestic product (GDP) in 2025 and drops to 5.2 percent by 2027 as revenues increase faster than outlays. In later years, outlays increase faster than revenues, on average. In 2035, the adjusted deficit equals 6.1 percent of GDP—significantly more than the 3.8 percent that deficits have averaged over the past 50 years.

This is how one economist puts it:

QUOTE STARTS

Trump’s tariffs are supposedly aimed at addressing this concern, with a view to balancing trade.

However, it is pretty much universally agreed that they will not work.

Macroeconomics tells us that a trade deficit is caused by an imbalance in savings and investment, plus the difference in government spending and tax revenue – i.e. the fiscal balance.

The US has a trade deficit because it runs an enormous fiscal deficit – currently around 5.5% of GDP and far higher than other rich countries.

If Trump truly wanted to move the US toward a trade balance, he would need to tackle this issue. While Elon Musk and DOGE are supposed to be reducing government spending, they are unlikely to make significant headway since achieving significant spending reductions will necessitate cuts to politically sensitive areas like Medicare and Medicaid.

Furthermore, Trump appears to be committed to tax cuts that will exacerbate the fiscal imbalance.

As such, tariffs targeted at specific countries, notably China, may affect the bilateral trade balance but, as happened in Trump’s first administration, that trade just gets displaced elsewhere, leaving the overall trade balance unaffected because the fundamental cause – the fiscal deficit – has not changed. https://www.kcl.ac.uk/trumps-tariffs-what-is-behind-them-and-will-they-work

So, the tariffs will do nothing to fix the trade deficit and that Trump needs to find a way to encourage investment by Americans if he thinks it's a problem. But with a very strong dollar many say it's not a problem to have increasing debt.

Increasing debt is not a problem if it also drives an increase in productivity and if the amount of interest on the debt remains low compared to the GDP especially since a large part of the interest on the debt is actually paid to Americans for instance the interest in the US debt actually helps to support pensions for Americans.

I go into that here.

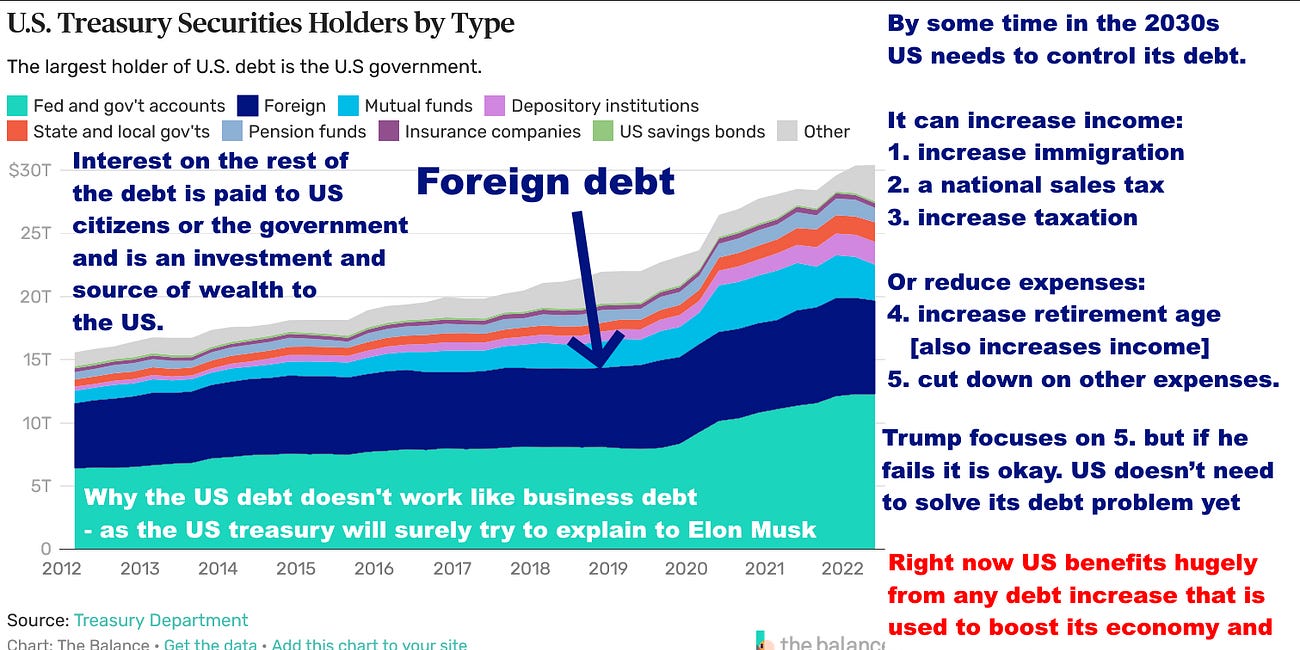

US doesn't have to control its debt in the 2020s - it's a source of wealth to Americans and speeds recovery from recession - and many ways to do it in the 2030s

The US does need to control its debt eventually but not until the 2030s. It is not like a household debt. It is actually a source of wealth to many Americans who invest in government bonds and most of the debt is owed to Americans.

Trump isn’t trying to drive the USA into a recession - far from it - he thinks this benefits the USA and he also is not doing this to hurt other countries - he thinks it will solve many problems

Trump isn't doing all this to hurt other countries or to cause problems for the USA. He genuinely believes that other countries are taking advantage of the USA by getting it to buy more than it sells, so that it builds up a debt and that he can get them to stop selling so much to the USA by using tariffs

He thinks this will then lead to more American industry to fill the gap. But economists say this won't work, that foreign investors would need to invest in the USA to build all that new industry if it does work like that as the US doesn't have enough savings to cover the investments. And that it will just lead to the same trade deficit as before, but in a different guise.

Trump has plenty of time to back out if he thinks it’s causing problems

There is a short term boost from the revenue from the tariffs but this doesn't last, it also leads to immediate price increases - and long term it leads to problems like rising prices, and Americans buying less and unemployment. But these problems only develop slowly and Trump has plenty of time to reverse out of it - months not days.

Trump getting resistance from Republicans - and risks losing special elections

So far Trump has just been able to say what tariffs he wants imposed and immediately do it.

But he is already getting resistance from his own party with 4 of them voting symbolically to overturn the tariffs in the Senate.

It’s also likely to get resistance from the voters once the prices rise and they get job losses.

In 2017 - 8 Trump lost 3 House seats and 1 Senate seat out of 14 special elections for the House and 3 for the Senate in those two years.

See: https://ballotpedia.org/Special_elections_to_the_115th_United_States_Congress_(2017-2018)

If Trump loses three special elections in the next 2 years he loses the House.

Tariffs are very vulnerable to legal challenges

Trump may well get significant challenges in the courts as the tariffs are legally dubious as a way to protect the US from enemies. He is using the International Emergency Economic Powers Act (IEEPA) which is meant to be used to regulate international commerce in response to an unusual threat to the USA

There has to be some rational connection between the tariffs and the threat.

To take a simple example, Trump has imposed 10% sanctions on several islands with few inhabitants and one that is uninhabited with only penguins living there in Antarctica.

Penguins graphic made with Bing copilot.

TEXT ON GRAPHIC:

There has to be some rational connection between the tariffs and the threat under the International Emergency Economic Powers act (IEEPA).

Background graphic done by Grok 3

There's no threat to the USA from penguins in an uninhabited Antarctic island.

The Heard and McDonald Islands in the remote Antarctic, which together form another Australian territory — this one uninhabited — is also on the list and subject to 10 percent tariffs.

The mostly barren islands between Madagascar and Antarctica have two active volcanoes and can only be reached by sea.

Contacted by the AP, the Australian government’s Antarctic Division did not immediately respond when asked about how the tariff might affect its operations in the islands.

Reaction of the penguins :) (just a joke of course they don’t know about the tariffs and this isn’t really those islands, can’t be as there’s nobody there)

Howard Lutnick, Trump’s commerce secretary, claimed implausibly that the tariffs are to prevent China from shipping goods via this remote penguin inhabited island to the USA.

Brennan: "Why are they on the list?"

Lutnick: He [Trump] said look I can't let any part of the world be a place where China or other countries can ship through them. So he ended those loopholes, these ridiculous loopholes."

In more detail:

Trump's tariffs use the International Emergency Economic Powers Act (IEEPA). It is the first time they've been used in such a broad way, and are highly vulnerable to legal challenges.

"If President Trump uses IEEPA authority to impose reciprocal tariffs it will signal rapid execution, while providing maximum flexibility to the president. Legal challenge would be likely, as this broad use of IEEPA authority is unprecedented."

https://www.reuters.com/legal/legalindustry/what-lies-ahead-tariffs-liberation-day-2025-03-28/

He did use IEEPA authority. He declared an international emergency and then used that to invoke IEEPA.

QUOTE By the authority vested in me as President by the Constitution and the laws of the United States of America, including the International Emergency Economic Powers Act (50 U.S.C. 1701 et seq.)(IEEPA), the National Emergencies Act (50 U.S.C. 1601 et seq.)(NEA), section 604 of the Trade Act of 1974, as amended (19 U.S.C. 2483), and section 301 of title 3, United States Code,

We have the first court case now, Emily Ley founder of the Simplified stationary business. She targets Trump’s use of the IEEPA and says that his Trump has not shown that his tariffs on China are necessary or tailored to deal with a drug trafficking emergency which is what he claims it is for China. Trump says he needs across the board tariffs on all goods from China in order to stop opiates.

QUOTE STARTS

The lawsuit on the other hand, argues that neither Trump nor his administration has shown that his actions are “necessary” or tailored to address a drug trafficking emergency. The lawyers cited Trump’s speech, where the American leader said that the tariffs are intended to reduce Trump deficit. In any case, the IEEPA allows for asset freezes, trade embargos and similar sanctions, but not tariffs, the suit argues.

The law “authorizes presidents to order sanctions as a rapid response to international emergencies. It does not allow a president to impose tariffs on the American people … Presidents can impose tariffs only when Congress grants permission,” the suit reads.

“Congress passed the IEEPA to counter external emergencies, not to grant presidents a blank check to write domestic economic policy."

“In the IEEPA’s almost 50-year history, no previous president has used it to impose tariffs. This is not surprising, since the statute does not even mention tariffs, nor does it say anything else suggesting it authorizes presidents to tax American citizens," it furthered.

Cases like that might take months to wend through the courts and perhaps end up in the Supreme Court in June.

However the way Trump has used them is such a stretch compared to the normal use of IEEPA that courts might decide it is clear enough to impose court injunctions.

Federal courts may see it as the president's mandate as he was voted in on a platform to impose tariffs. So they'd be reluctant to just stop them without going through the court process.

But the Federal courts do have the power and in principle could issue an injunction to stop the tariffs.

The Supreme Court changed direction under Loper Bright Enterprises v. Raimondo (2024) which overturned the previous Chevron U.S.A., Inc. v. NRDC (1984) ruling.

The details aren't important here, the main thing is this limited the president's power which shows the Supreme Court is sympathetic to arguments that limit what the president can do - in the case of the Chevron ruling it strengthened the courts at expense of the president. .

Then they could also argue that the tariffs go against the rule that Congress has to explicitly delegate such major powers to the president.

There are various legal principles including the major questions doctrine. That is the idea that major questions should be resolved by Congress unless Congress explicitly delegated it to the president.

https://reason.com/volokh/2025/03/29/challenging-trumps-tariffs-under-the-major-question-doctrine/#

Then, the emergency powers act isn't even about tariffs and it needs a rational connection so this can be challenged. This comment was for the earlier tariffs with Canada and Mexico:

QUOTE In addition, opponents may argue that countrywide tariffs are not rationally connected to the declared national emergency on illegal immigration and illicit drug trade. As support, they may point to the inclusion and unequal treatment of goods with no apparent relation to illegal immigration or the flow of fentanyl—for example, the lower tariffs imposed on Canadian energy imports. https://www.jenner.com/en/news-insights/publications/client-alert-tariffs-on-trial-the-legal-issues-raised-by-new-tariffs-on-canada-mexico-and-china

And this is a lawfare article which mainly focuses on the need for a logical connection between the emergency - this was for the previous Canada and Mexico tariffs, ending:

QUOTE It is unclear whether embedding a national emergency declaration in an executive order imposing tariffs satisfies the requirements of the NEA that emergency powers can be exercised only when the president “specifically declares a national emergency” via a proclamation that is immediately transmitted to Congress and published in the Federal Register, nor the requirement in IEEPA that the president, “in every possible instance,” consult with Congress before taking action.

...

To permit IEEPA—a statute that does not mention tariffs and is designed to deal with unusual and extraordinary threats to America’s national security—to be used to impose tariffs at whatever level the president decides in order to create leverage to address any national emergency, no matter how disconnected from trade or imported goods, is to suggest that there are virtually no limits on the president’s power to impose tariffs.

So there may well be challenges in this case because he has taken this so far and essentially said a president can impose any tariffs on any country by embedding a declaration of a national emergency in an executive order without explaining how the emergency relates to the tariffs. .

The main thing then is whether the courts would go as far as to issue an injunction to stop them if asked to. If not then it would surely end up at the Supreme Court by June. Then it would be up to them and the current court is interested in curbing the president's power - which the Republicans cheered about under Biden but won't be so keen under president. Trump. But the court decides things based on legal interpretative philosophy and can be expected to apply the law similarly for Trump as for Biden.

It would take months to find the outcome of those challenges, assuming they get to the Supreme Court they make their decisions in June usually. But still there is some potential they could stop the tariffs if still in place by the summer. It's likely impossible to predict how they would decide on this. The new Supreme Court is more favorable to these kind of arguments than it used to be so it may rule against Trump.

QUOTE STARTS

President Trump’s “Liberation Day” reciprocal tariffs on a broad swath of U.S. trading partners could be more exposed, given their unprecedented scope. Importers are likely to argue

(1) that the reciprocity tariffs violate the Supreme Court’s recent revival of the “major questions doctrine” under Chief Justice Robert’s opinion in West Virginia v. Environmental Protection Agency, 597 U.S. 697 (2022), which held that administrative agencies do not have the power to regulate on a “major questions” of extraordinary economic and political significance unless they have clear statutory authority from Congress; and

(2) that the statutes violate the nondelegation doctrine because they completely cede Congress’s power to levy tariffs to the president without providing an intelligible principle or constraining guidelines on how to implement such tariffs.

While the non-delegation doctrine has been a dead letter since the 1930s, some of the conservative justices (e.g., Justice Gorsuch) have expressed an interest in revisiting it (and a nondelegation challenge to the FCC’s University Service Fund is currently before the Supreme Court in Federal Communications Commission v. Consumers’ Research).

Any challenges to the Trump tariffs will initially be heard at lower levels but will likely get to the Supreme Court eventually. As discussed above, both the Supreme Court and lower courts have repeatedly upheld tariff statutes against nondelegation attacks.

QUOTE As a practical matter, many federal judges will likely be unwilling to check the president’s authority because they perceive his tariff policies as having just received a popular mandate and because they are reluctant to second-guess a presidential determination of an emergency or national security threat. As explained in our previous paper, one key issue to watch is whether lower-level judges are willing to preliminarily or temporarily block a presidential action that rests on a declaration of emergency or national security finding while the litigation plays out. https://www.csis.org/analysis/are-president-trumps-trade-actions-exempt-administrative-procedure-act

This is about the ruling that overturned Chevron.

BLOG: Yes Federal Agencies can still regulate on environment, food, medicine etc after Supreme Court overturned Chevron

— about unclear laws

— previous clarifications still apply

— may lead to more stability

Effect on the EU minor compared to effect on the USA

The big tariffs on China will lead to China sending its low price goods to the EU instead of the USA, raising prices in the US and reducing them in the EU. Also the EU is such a large single market, that the tariffs will lead to people in the EU buying more from each other and the manufacturers in the EU selling their goods to the EU they would otherwise send to the US.

So it likely reduces prices in the EU. Longer term then it's hard to know what happens.

Low prices could lead to consumers postponing buying things as they wait for prices to fall further. That risks deflation and a recession so the EU will need to act to protect against that.

https://www.euronews.com/my-europe/2025/04/04/what-impact-will-new-us-tariffs-have-on-the-wallets-of-people-in-europe

The impact is far more for the US than for the EU.

QUOTE The Conference Board, a US-based think tank, similarly estimated that Trump’s policies could reduce the EU’s GDP by 0.2 percentage points this year, well below the hit to US GDP of 1.2 percentage points.

https://ec.europa.eu/commission/presscorner/detail/en/qanda_25_750

The EU is trying to negotiate the tariffs with Trump. But are preparing countermeasures in case the negotiations fail.

QUOTE STARTS

We are already finalising a first package of countermeasures in response to tariffs on steel.

And we are now preparing for further countermeasures, to protect our interests and our businesses if negotiations fail.

We will also be watching closely what indirect effects these tariffs could have, because we cannot absorb global overcapacity nor will we accept dumping on our market

As Europeans we will always promote and defend our interests and values.

And we will always stand up for Europe.

But there is an alternative path.

It is not too late to address concerns through negotiations.

https://ec.europa.eu/commission/presscorner/detail/ro/statement_25_964

She doesn't go into details but the EU response would be based on economics which is now a science so there is much they can do to counteract the tariffs.

Effects on the UK

The UK is one of those affected because of 10% tariffs and our significant levels of trade with the USA. Prices could go up if the tariffs increase the value of the dollar, so that you pay more in GB pounds for goods priced in dollars.

However they could also go down if other countries divert low price goods to the UK that they would otherwise sell to the US. For instance many countries, especially China, won't be able to sell low cost goods to the US any more so they may then send more to us, reducing our prices.

https://www.bbc.co.uk/news/articles/czd35l8995eo

The Bank of England may keep interest rates at its current high level for longer than previously expected (before the tariffs), to offset the short term price rises.

But it may also reduce interest rates faster than it was going to anyway to counteract possible harmful effects on the economy of the tariffs.

QUOTE STARTS

"The Bank of England will face a dilemma. On the one hand, tariffs are going to lift the prices of some goods and its core remit is to keep a lid on inflation, as close to 2% as possible, which would point to rates staying higher for longer than previously expected.

"On then other, the Bank has taken a wider view of the economy in the last decade or so, taking growth and jobs into account in its monetary policy, particularly when dangerous shocks emerge. As during the pandemic, it will want to support the economy from sinking into recession. It is quite possible that they will regard price spikes related to the implementation of tariffs as a one-off shock and focus more on the risk of economic stagnation.

"It’s not unthinkable that we will actually see interest rates come down more rapidly than expected. Of course any serious hit to UK economic growth could be felt in the jobs market, not just in terms of job insecurity but also in that firms suffering uncertainty – as well as the tax rises already in effect - could restrict wage and salary growth."

https://uk.finance.yahoo.com/news/trump-tariffs-bank-england-interest-rate-cuts-trade-090845022.html

In a recession the risk is often (not always) deflation not inflation. The main counter example is stagflation where inflation increases but unemployment stays high.

As a general principle, you reduce bank interest rates to encourage growth, you increase interest rates to stop inflation.

https://www.investopedia.com/ask/answers/102015/do-interest-rates-increase-during-recession.asp

So, if the Bank of England thinks the risk of inflation is low, they may reduce interest rates faster than they were going to anyway to strengthen the economy.

Stock market crashes mean little to most people

The stock market often crashes. Banks, and the economy generally are insulated from it for instance the dot com bubble wiped out the wealth of many entrepreneurs but had negligible effect on the economy.

The stock market is not closely tied to the economy, it's independent. People who buy stocks and shares have to be willing to take risks - and banks don't invest in stocks that can crash like this and same also for other major parts of the economy. They know the stock market crashes often. The US economy continues with a strong recovery from the recession.

The stock market varies a lot. You can see that here:

https://www.spglobal.com/spdji/en/indices/equity/sp-500/#overview

Going up but with sudden falls. The big drop in 2020 is because of the pandemic but the other ones are things only stock market traders noticed.

And the 2020 dip was a result not a cause of the lockdowns.

Also from: https://www.macrotrends.net/2324/sp-500-historical-chart-data?q=.

Nobody else notices those fluctuations just the ones with stocks and shares.

They will rebound

This is just normal.

Pettis’s coffee example in detail

Let’s look a bit more at his coffee example. US does produce some coffee from Hawaii. A coffee company in California grows a small amount of coffee but but it’s likely to cost too much when scaled up. Apart from that the main potential coffee grower is central Florida, but this is experimental so far.

The temperature is okay using microjet systems to protect young coffee plants

There is enough rain in Polk city, with irrigation for droughts

Florida can’t provide the high altitude conditions coffee prefers but it might staill work

Would it taste good? It’s too early to say as they haven’t yet grown any Floridan coffee

https://dailycoffeenews.com/2021/04/06/exploring-the-possibility-of-florida-grown-coffee/

So this is a good example, highly unlikely that the tariffs on imported coffee will boost the small and experimental work towards coffee production in Florida, and it may boost coffee production in Hawaii - that’s about it. There’s no way this could make up for imports of coffee.

Pettis’s article is here: Tariffs are a misunderstood tool

About 80 percent of U.S. unroasted coffee imports came from Latin America (valued at $4.8 billion), principally from Brazil (35 percent) and Colombia (27 percent).

Brazil and Columbia are at the lowest tier of tariffs at 10%. But still are tariffed.

https://www.bbc.co.uk/news/articles/c5ypxnnyg7jo

Proposal for a “coalition of the willing” of states that voluntarily comply with World Trade Organization (WTO) rules

There's a new idea in the EU of the "coalition of the willing" - a suggestion that they might work with other countries also affected by Trump's tariffs such as China to form a coalition of countries that collectively agree voluntarily to keep to WTO rules even though US doesn't.

The Trump tariffs would almost certainly be ruled to be against WTO rules but the US has stopped WTO from functioning by refusing to send judges to it to listen to cases so it's not a quorum and can't decide cases any more.

https://www.wto.org/english/tratop_e/dispu_e/appellate_body_e.htm

QUOTE STARTS

Under WTO guidelines, member nations commit to “tariff bindings”, which set maximum tariff levels that cannot be exceeded unless renegotiated. For the US, the average bound tariff for all goods is 3.4 per cent. These commitments, outlined in each country’s Schedule of Concessions, ensure stability and predictability in trade.

...

In the past, the Trump administration cited national security under Section 232 of the US Trade Act to impose additional tariffs—25 per cent on steel and 10 per cent on aluminium. The WTO later ruled these measures violated trade rules, stating that national security clauses must not be applied arbitrarily.

Despite the ruling, the US refused to reverse the tariffs, asserting national security as a sovereign matter. Washington has also blocked appointments to the WTO’s Appellate Body, effectively paralysing the appeals process.

...

As Trump’s reciprocal tariffs come into effect, they are likely to invite WTO challenges from affected trading partners. Whether or not countries pursue formal action, the move is expected to intensify ongoing tensions over WTO reform and the US position on global trade governance.

CONTACT ME VIA PM OR ON FACEBOOK OR EMAIL

You can Direct Message me on Substack - but I check this rarely. Or better, email me at support@robertinventor.com

Or best of all Direct Message me on Facebook if you are okay joining Facebook. My Facebook profile is here:. Robert Walker I usually get Facebook messages much faster than on the other platforms as I spend most of my day there.

FOR MORE HELP

To find a debunk see: List of articles in my Debunking Doomsday blog to date See also my Short debunks

Scared and want a story debunked? Post to our Facebook group. Please look over the group rules before posting or commenting as they help the group to run smoothly

Facebook group Doomsday Debunked

Also do join our facebook group if you can help with fact checking or to help scared people who are panicking.

SEARCH LIST OF DEBUNKS

You can search by title and there’s also an option to search the content of the blog using a google search.

CLICK HERE TO SEARCH: List of articles in my Debunking Doomsday blog to date

NEW SHORT DEBUNKS

I do many more fact checks and debunks on our facebook group than I could ever write up as blog posts. They are shorter and less polished but there is a good chance you may find a short debunk for some recent concern.

I often write them up as “short debunks”

See Latest short debunks for new short debunks

I also tweet the debunks and short debunks to my Blue Sky page here:

I do the short debunks more often but they are less polished - they are copies of my longer replies to scared people in the Facebook group.

I go through phases when I do lots of short debunks. Recently I’ve taken to converting comments in the group into posts in the group that resemble short debunks and most of those haven’t yet been copied over to the wiki.

TIPS FOR DEALING WITH DOOMSDAY FEARS

If suicidal or helping someone suicidal see my:

BLOG: Supporting someone who is suicidal

If you have got scared by any of this, health professionals can help. Many of those affected do get help and find it makes a big difference.

They can’t do fact checking, don’t expect that of them. But they can do a huge amount to help with the panic, anxiety, maladaptive responses to fear and so on.

Also do remember that therapy is not like physical medicine. The only way a therapist can diagnose or indeed treat you is by talking to you and listening to you. If this dialogue isn’t working for whatever reason do remember you can always ask to change to another therapist and it doesn’t reflect badly on your current therapist to do this.

Also check out my Seven tips for dealing with doomsday fears based on things that help those scared, including a section about ways that health professionals can help you.

I know that sadly many of the people we help can’t access therapy for one reason or another - usually long waiting lists or the costs.

There is much you can do to help yourself. As well as those seven tips, see my:

BLOG: Breathe in and out slowly and deeply and other ways to calm a panic attack

BLOG: Tips from CBT

— might help some of you to deal with doomsday anxieties

PLEASE DON’T COMMENT HERE WITH POTENTIALLY SCARY QUESTIONS ABOUT OTHER TOPICS - INSTEAD COMMENT ON POST SET UP FOR IT

If you have potentially scary questions about any other topic please post here: https://robertinventor.substack.com/p/post-to-comment-on-with-off-topic-29a Post to comment on, with off topic potentially scary comments - or send me a private message - or use our group on Facebook

The reason is I often aren't able to respond to comments for some time and the unanswered comment can scare people who come to this post for help on something else

Also even when answered the comment may scare them because they see it first.

It works much better to put comments on other topics on a special post for them.

It is absolutely fine to digress and go off topic in conversations here - this is specifically about things you want help with that might scare people.

PLEASE DON’T TELL A SCARED PERSON THAT THE THING THEY ARE SCARED OF IS TRUE WITHOUT A VERY RELIABLE SOURCE OR IF YOU ARE A VERY RELIABLE SOURCE YOURSELF - AND RESPOND WITH CARE

This is not like a typical post on substack. It is specifically to help people who are very scared with voluntary fact checking. Please no politically motivated exaggerations here. And please be careful, be aware of the context.

We have a rule in the Facebook group and it is the same here.

If you are scared and need help it is absolutely fine to comment about anything to do with the topic of the post that scares you.

But if you are not scared or don’t want help with my voluntary fact checking please don’t comment with any scary material.

If you respond to scared people here please be careful with your sources. Don’t tell them that something they are scared of is true without excellent reliable sources, or if you are a reliable source yourself.

It also matters a lot exactly HOW you respond. E.g. if someone is in an area with a potential for earthquakes there’s a big difference between a reply that talks about the largest earthquake that’s possible there even when based on reliable sources, and says nothing about how to protect themselves and the same reply with a summary and link to measures to take to protect yourself in an earthquake.

Thanks!

Thank you for including your sources.

Please note that although the sources you included say a recession is not likely, that doesn't give the full picture. Most importantly, the probability numbers you're including are substantial increases from previous probabilities this year. Also important to note is that usually probabilities of recession are much lower than these numbers.

JP Morgan puts recession odds this year at 60%, Goldman Sachs at 35% (up from their previous 20%), and Moody's at 40% (up from 15%): https://www.economictimes.com/news/international/global-trends/there-will-be-blood-jpmorgan-warns-of-60-global-recession-odds-under-trump-tariffs/articleshow/119965761.cms

Those numbers appear to be assuming that the tariffs are sustained. If they're not sustained, then recession is presumably less likely. They don't define how long "sustained" is, either.

The uncertainty around Trump's actions will make people hesitant to invest in businesses and things, which has the potential to push the country into recession or stagflation (https://www.newyorker.com/news/the-financial-page/will-trumpian-uncertainty-knock-the-economy-into-a-recession ). Investors like predictability, and fear is bad for markets and investors.

Congress has the ability to stop Trump's tariffs (they need a supermajority to get past the presidential veto): https://www.nbcnews.com/politics/congress/republicans-weigh-using-power-congress-rein-trump-tariffs-rcna199555 . People in the US can call their elected representatives and Senators and protest. Nothing is written in stone; even a recession, though rising in probability, is nowhere near a certainty.

I believe you're going to have to do an article on the Insurrection Act because there's a lot of people borrowing a cup of trouble and do not know exactly what's going on